|

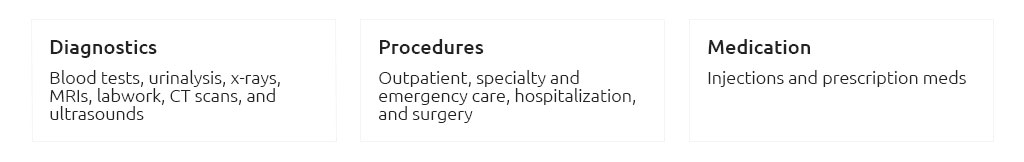

pet insurance sarasota insights from the SuncoastWhy coverage matters along the GulfHeat that lingers, sudden storms, and weekend beach runs make life here vivid - and occasionally risky - for dogs and cats. I've seen calm mornings turn into vet visits after a shell cut or a red-tide tummy upset. Odds vary by pet, and I'm careful not to overstate them, yet the consequences of a bad day can be pricey. How policies actually work hereMost plans reimburse you after you pay the clinic. Some carriers now offer limited direct pay to vets, but it depends on the practice's comfort level and the claim's size. Pre-approvals help for big procedures; routine visits rarely need them. Tele-vet lines often run 24/7, which is handy during late-night storms or holiday weekends. Core protections to compare- Accidents: cuts at the bayfront, sprains from park sprints, heat-related emergencies.

- Illness: GI upsets, skin issues, ear infections, and chronic conditions.

- Hereditary/orthopedic: hip, knee, and breed-specific concerns; watch waiting periods.

- Dental trauma: cracked teeth from a rogue seashell; disease coverage is often separate.

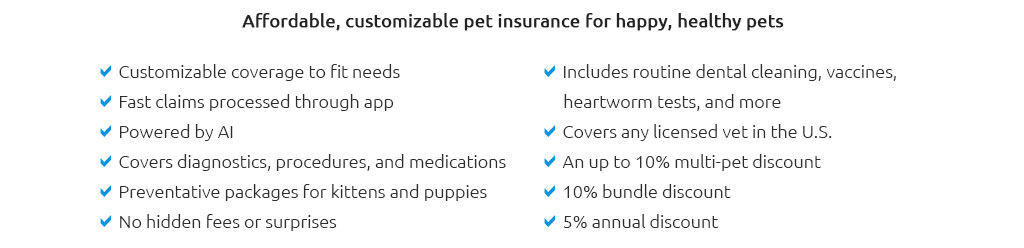

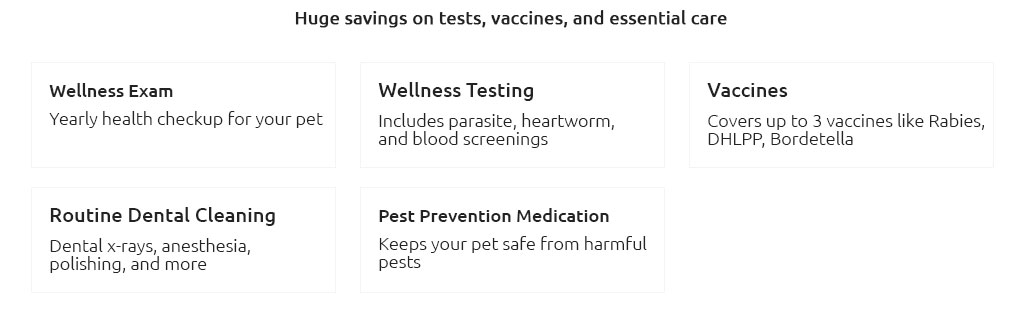

- Wellness add-ons: vaccines, preventives, and annual exams; useful but not essential for everyone.

- Behavioral/rehab/alt therapies: covered by some, excluded by others.

- Prescriptions and special diets: sometimes partial, sometimes not at all.

Costs you can expectPremiums in Sarasota tend to run a bit higher than national averages. For many dogs, mid-range plans land somewhere in the rough $40 - $90/month zone; cats often less. Specifics swing by breed, age, and ZIP. That uncertainty is real, but choosing a sensible deductible keeps the monthly number predictable. - Breed and age: larger and older pets cost more; starting earlier usually helps.

- ZIP details: coastal risks and local vet fee norms influence quotes.

- Deductible/coinsurance: higher deductible lowers monthly cost; balance against emergency affordability.

- Annual limit: $5k works for many; unlimited is calmer but pricier.

Local realities that nudge decisions- Heat and humidity: dehydration, hot pavement burns, heatstroke - quick treatment matters.

- Storm season: evacuation boarding and travel mishaps; some plans reimburse limited boarding.

- Water and wildlife: cuts, stings, and occasional toxin exposures; check exclusions language.

- Sago palms: common landscaping; ingestion can be severe - confirm toxin coverage.

- No networks: you can use most Sarasota clinics; direct pay is hit-or-miss, so be ready to reimburse.

Late one August evening at Payne Park, I watched a terrier catch a paw on a hidden edge. The owner snapped photos, filed a claim from the parking lot of an urgent-care vet just off I-75, and the reimbursement landed two days after the invoice cleared. Quiet efficiency, no drama. Usability and accessibility- Simple claims: camera-upload invoices, in-app status, direct deposit.

- Accessible apps: readable fonts, strong contrast, solid screen reader support; phone lines with TTY when needed.

- Language options: Spanish materials and bilingual reps help many Sarasota families.

- Flexible payments: monthly autopay, paper checks on request, and downloadable itemized statements.

Choosing without overbuying- List real risks: age, breed, habits (beach, trails, condo stairs), and your emergency fund.

- Ask your vet which emergencies they see most; treatment ballparks are gold.

- Pick a deductible you could cover on a tough day; set coinsurance at 70 - 90%.

- Start with accident/illness; add wellness only if it truly offsets routine costs.

- Revisit at renewal; if prices climb, compare but don't sacrifice lifetime condition coverage.

Questions worth asking providers- Exact waiting periods for accidents, illness, knees, and hips.

- Are exam fees during emergencies covered?

- Does the plan keep chronic conditions covered year to year?

- Difference between dental trauma and dental disease coverage.

- How they handle environmental toxins (e.g., algal bloom exposure) and sago palm ingestion.

- Any caps on rehab, behavioral, or alternative therapy visits.

Filing claims, fastA usable process beats theoretical coverage. Keep it simple and repeatable. - Save the itemized invoice and medical notes; photograph in good light.

- Submit via app the same day; add short context in your words.

- Opt for direct deposit and notifications; review the explanation of benefits.

- For large surgeries, ask about pre-approval to reduce surprises.

A quick pre-enroll checklist- No coverage for pre-existing conditions; understand how "curable" issues are treated.

- Look for lifetime treatment for conditions that start after enrollment.

- Confirm travel coverage across Florida and out of state.

- Ask about any direct pay feature to local clinics, even if limited.

- Read cancellation and renewal terms; note how rates adjust with age.

The right plan here is the one you can use on a busy weekday, from your phone, with clear updates and money back quickly. The details may shift by pet and neighborhood, but confidence comes from fit and usability, not marketing promises.

|

|